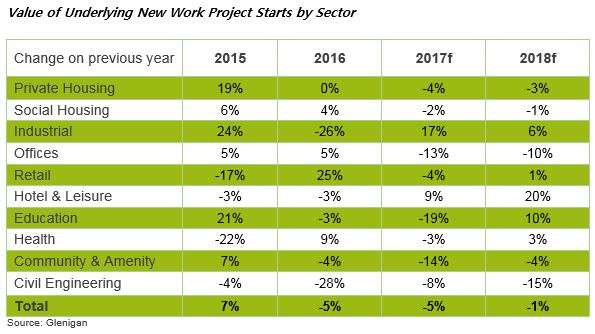

Glenigan expects the value of construction starts to stabilise in 2018, after the declines seen over the last two years, as construction clients adapt their investment plans to the changing political and economic environment.

Commenting on the prospects for the industry, Glenigan’s Economics Director, Allan Wilén said “The value of underlying construction projects has fallen back this year amid continued political and economic uncertainty, delays to public sector projects and a weakening in housing market activity.”

“Whilst a weak UK economy is forecast to constrain construction activity over the coming year, we anticipate greater stability in overall construction starts as strong growth in hotel and leisure, industrial and education work help offsets weakness elsewhere.”

“The industrial sector is forecast to be a growth area as technological and social changes reshape consumers’ retail habits and drive the demand for logistics space. We expect these structural changes to be a long term driver for warehousing and logistics projects as online retailing takes an ever larger share of retail sales and as retailers adapt to changing spending patterns and shopping habits. The Midlands, North West and parts of the South East of England are favoured locations for such facilities, offering good access to national transport networks and the UK’s major population centres.”

“The hotel & leisure is also forecast to be a growth sector over the coming year. Consumer spending on leisure activities remains firm and the sector is benefiting from the depreciation in the pound over the last two years which has boosted UK tourism and encouraged UK consumers to holiday at home.”

“Demographic changes are set to shape the pattern of construction activity. Increased investment is anticipated to expand the secondary school estate in order to accommodate rising pupil numbers, especially in the UK’s major conurbations. In addition universities are investing in new facilities as they compete for UK and overseas students.”

“Growth in these areas will help offset weakness in the private housing and office sectors.”

“Real household earnings growth has stalled due to weak wage growth and higher inflation. This is forecast to slow housing market activity, with weak new house sales holding back sector activity. The value of private housing projects starting on site is forecast to drop 3% next year as housebuilders prioritise building out current developments and open fewer sites.”

“Political and economic concerns arising from the EU referendum depressed office project starts during 2016 and 2017. These concerns are expected to persist as investors appraise the implications of Brexit and of slower UK economic growth for the demand for office space and rental values. Developments in the City of London and Docklands will be especially vulnerable with weaker demand for accommodation as financial institutions consider relocating operations to elsewhere within the EU.”

“Major infrastructure schemes, including, Thames Tideway, HS2 and Hinckley Point, are forecast to drive civil engineering activity next year. The value of smaller scale projects starting on site have fallen back sharply this year and are expected to weaken further in 2018 as investment is dominated by flagship projects.”

A full copy of the Glenigan Outlook Forecast is available to download here.